BluGlass pushes to commercialize RPCVD

The technology has a history that dates back to the last century. The company was founded in June 2005 after more than 15 years of research at Sydney’s Macquarie University and to raise funds floated on the Australian Stock Exchange in September 2006.

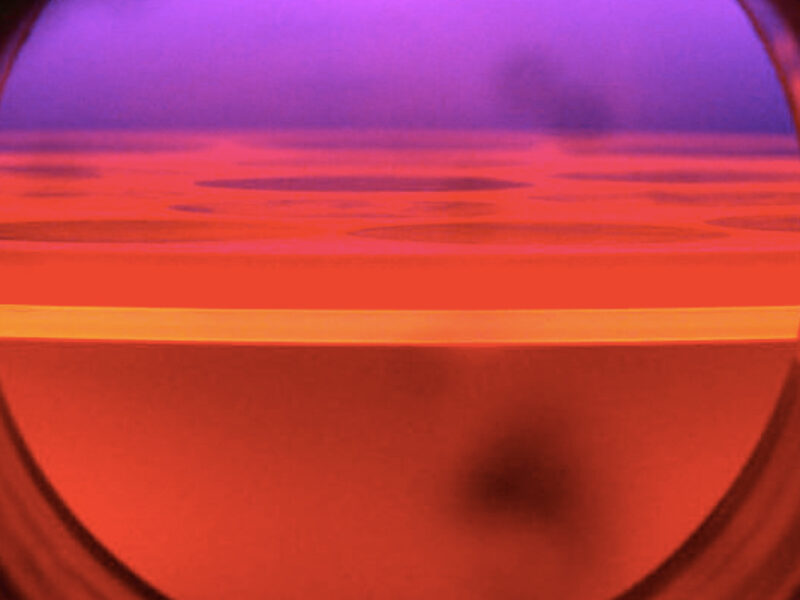

Since then progress has been slow but steady as the company has sought to establish the key advantage of RPCVD over the metal-organic chemical vapor deposition (MOCVD) used for making compound semiconducting thin films and micro/nano structures. In the case of nitride layers such as aluminium-nitride and gallium-nitriide RPCVD uses nitrogen gas from a remote source – rather than ammonia – and deposition then occurs at a significantly lower temperature and can preserve the integrity of previously deposited materials and structures. This has advantages for p-GaN grown on top of MOCVD-deposited multi-quantum wells in LEDs where it is claimed to provide for better defined layer structures and increased LED efficiency.

To date BluGlass has been mainly engaged in development work and partnerships. Its route to market is to provide a specialized reaction chamber that can be retrofitted to pre-existing MOCVD machines from such vendors as Aixtron and Veeco and then to license its manufacturing technology. The chambers support wafer sizes up to 300mm diameter.

“We do have some contract manufacturing using MOCVD and RPCVD machines, but our business model is about licensing the technology and providing the chamber,” Giles Bourne, CEO of BluGlass, told eeNews Europe in an interview. The foundry work takes place under the EpiBlu brand name.

BluGlass has been operating at a loss in recent quarters but Bourne is optimistic that after many years of development work the market is finally coming towards his company’s technology. Bourne said the money raised recently is being used to add processing machines in its Australian pilot facilities but, more importantly, to enhance its sales and marketing footprint in the United States and Europe.

The biggest opportunity is in LED and specialized LED manufacture but with additional longer-term opportunities in the many additional areas where GaN may be deployed. These include microLEDs, RF and power semiconductors as well as compound semiconductor photovoltaics. “We are already doing work in power at Griffith University,” said Bourne.

Bourne added that while novel applications of GaN are exciting possibilities for the future the priority has to be the market that is available now – mainstream discrete LED manufacture. “We have to commercialize this technology,” he said.

Next: Partnerships in place

The company has a number of development partnerships in place that could bear fruit soon.

These include one with LED lighting manufacturer Lumileds Holding BV (Amsterdam, The Netherlands) that was extend in March 2018 to accelerate the development of LEDs for new applications using RPCVD technology. BluGlass is collaborating with Veeco Inc. on equipment, with IQE plc on the creation of crystalline rare-earth oxides (cREO) and has also entered into a collaboration with a “well-funded” European pioneer of microLEDs that BluGlass has not named.

One microLED company that fits this description is Aledia SA (Grenoble, France), a pioneer of GaN-on-silicon that raised €30 million (about $37 million) in a series C funding round led by Intel Capital in January 2018. Aledia has raised more than US$80 million since it was founded in 2011.

To help with commercialization of its technology BluGlass has appointed US-based Brad Siskavich as vice president of business development. But although BluGlass is reaching out to the US and Europe, the company is well-placed geographically to engage with southeast Asia and China.

Bourne commented: “You can’t ignore China. We’ve made forays into that market but you have to go in with your eyes wide open, particularly with regard to intellectual property.” But he added that the rise of Chinese equipment vendors could be a tide that helps raise BluGlass fortunes. “There are equipment companies there, such as AMEC, that have sold hundreds of machines albeit mainly in China, that are going international.”

Related links and articles:

News articles:

Intel, Ikea back nanowire LED pioneer Aledia

IQE taps Australian tech for wide bandgap wafers

RPCVD p-GaN offers 10-fold improvement in LED efficiency

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News